MAKING YOUR FUTURE A SUCCESS

Plan for tomorrow today!

Welcome to The Pam Group LLC

Since 1987, I’ve dedicated my career to helping individuals and families build financial security and peace of mind through The Pam Group. With expertise in trust planning, advanced life insurance strategies, and annuity programs, I provide customized solutions that ensure the growth, security, and control of your income—no matter how long you live.

Over the years, I’ve had the privilege of counseling and educating thousands of seniors on how to preserve their assets, reduce taxes, and increase retirement income. My strategies are designed to help you keep more of what you’ve worked so hard to earn, and my experience has shown me that these are the cornerstones of a strong retirement and income plan.

Every morning, I look forward to making a tangible difference in the lives of my clients. For me, this isn’t just a job—it’s a calling. As we work together, my clients often become like family. I’m always here to answer your questions or simply talk about what’s on your mind. (Yes, I do return calls!)

There’s nothing more rewarding than seeing the peace of mind my clients feel when they know their retirement plan is in place, their assets are protected, and their future is secure. If you’re ready to create a financial plan that works for you, I’d be honored to help.

📞 Contact me today to start building the retirement you’ve always dreamed of.

Ask Us A Question

Take Our Free Retirement Assessment!

Take 5 minutes and receive a FREE Report providing you with guidance, direction and a renewed sense of confidence about your future.

Free Reports

Recent News

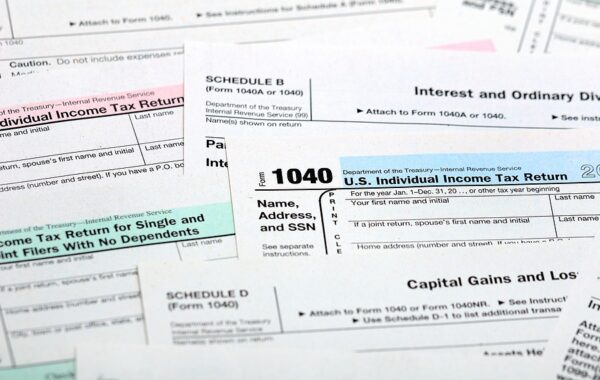

Understanding the Difference Between Income Tax and Capital Gains Tax

In the realm of taxation, two ...

Read moreDemystifying the Life Insurance Medical Exam: What to Expect During the Underwriting Appointment

Applying for life insurance ...

Read moreHoliday Giving That Gives Back: Tax-Smart Charitable Strategies

During the holiday season, ...

Read moreDecember Deadlines That Matter: Universal Year-End Financial Tasks

As the year draws to a close, ...

Read moreNovember Rate Watch: How Interest Changes Affect Annuity Decisions

Understanding how interest ...

Read moreVeterans Day Financial Benefits Review: Insurance and Tax Strategies

On Veterans Day, we honor ...

Read moreNational Caregivers Appreciation Month: Improving Lives and Communities

National Caregivers ...

Read moreMental Health and Money: Addressing Financial Anxiety in Uncertain Times

Financial confidence is a ...

Read moreLabor Day Legacy: Teaching Children About Work, Money, and Retirement

Labor Day, a nationally ...

Read more

Asset Protection

We help clients protect and preserve their financial futures through wealth building and smart tax strategies.

Needs Analysis

Let’s discuss your current situation and find out what opportunities you may be able to take advantage of.

Policy Review

Visit our interactive video center to learn more about how smart financial decisions can save you thousands of dollars.